Why choose a credit union

| Credit Unions | Banks | First Tech Advantage | |

|---|---|---|---|

| Business Structure | Not-for-profit, financial cooperative with volunteer board members | For-profit financial company with paid board members | You are an owner |

| Eligibility | Membership is limited to groups of people based on an affiliation | Everyone | We specialize in meeting your unique needs |

| Access | CUs partner to offer comparable branch/ATM access nationwide | ATM and branch networks vary | CUs work together to give you greater access |

| Fees, Incentives and Rates | Typically offers lower fees and loan rates, and higher deposit rates | Often charges more expensive fees, higher loan rates and pays lower deposit rates | As a not-for-profit organization, we save members more |

| Deposit Insurance | Funds are insured to at least $250,000 by NCUA | Funds are insured to at least $250,000 by FDIC | Equal benefit |

Exclusive Microsoft discounts

Dividend Rewards Checking minimum opening balance $0.01. As of 05.01.17, the Annual Percentage Yield (APY) is 1.58% on balances between $.01 and $10,000 and 0.16% APY on balances over $10,000 for each calendar month if the minimum qualification are met. Rates are subject to change after the account is open. Qualifications per monthly cycle are 12 debit card purchases, 1 direct deposit or ACH withdrawal, and receipt of electronic statements. Qualifying transactions must post to your account prior to the last day of the month. Debit card purchases can take up to 3 days to post and are dependent on merchant processing times. If the requirements per qualification period are not met, the dividend rate and corresponding APY earned will be the non-qualified rate. If you do not meet the qualification requirements you will still receive the bonus. The bonus is considered interest and will be reported on IRS form 1099-INT. Account is subject to approval and membership qualifications. Membership Savings Account required prior to obtaining other products or services. Rates, terms and conditions subject to change at any time.

Home and Vehicle Loans: Offers valid for Microsoft employees only and are subject to meeting First Tech Federal Credit Union’s membership requirements and underwriting policy guidelines. APR is annual percentage rate. Discounts cannot be combined with other offers and are subject to program guidelines. Rates and terms are subject to change without notice.

Products and services

Comprehensive product suite leads to member savings

|

Bank |

Borrow |

Insure1 |

Invest2 |

|---|---|---|---|

1Insurance products offered through First Tech Insurance Services, a wholly-owned subsidiary of First Tech Federal Credit Union.

2Registered branch address: 1011 Sunset Blvd, Rocklin, CA 95765 | 855.744.8585

Financial Advisors offer securities through Raymond James Financial Services, Inc. Member FINRA/SIPC and securities are not insured by credit union insurance, the NCUA or any other government agency, are not deposits or obligations of the credit union, are not guaranteed by the credit union, and are subject to risks, including the possible loss of principal. First Tech Federal Credit Union and Addison Avenue Investment Services are not registered broker/dealers and are independent of Raymond James Financial Services, Inc. Investment advisory services offered through Raymond James Financial Services Advisors, Inc.

Calculate your potential savings

Financial and retirement planning

A Personalized Approach for Your Future Addison Avenue Investment Services is the investment services division of First Tech Federal Credit Union. Our team of Financial Advisors provides personalized solutions to help you plan for your successful financial future. Our Areas of Expertise

Registered branch address: 1011 Sunset Blvd, Rocklin, CA 95765 | 855.744.8585

|

Financial wellness resources

The financial decisions you make today can have a long-term impact on your life. We offer tools to help you make the best decisions for you and your family.

| Financial Wellness Center | Financial Calculators |

|---|---|

| Online learning module topics include: | Determine what it takes to reach your goals: |

|

|

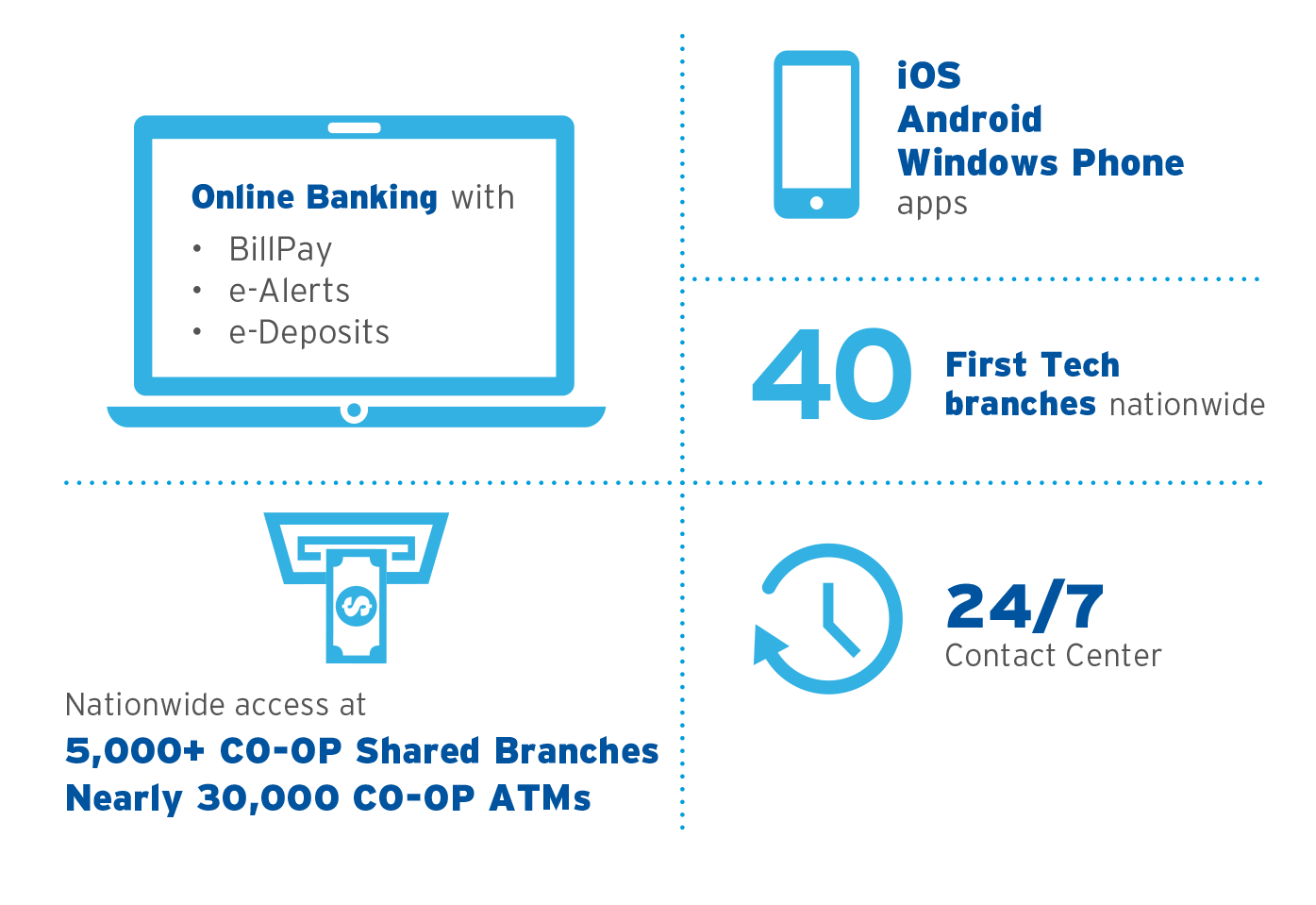

Online Banking with :

Online Banking with :

|

Find nearby branches and ATMs